Trading Signals: The Essential Guide to Reading and Acting with Confidence – The Novice Trader’s Playbook

Ever See a “Buy Signal” and Freeze?

I remember staring at my first MACD crossover, thinking, “Is this it? Should I click ‘buy’ now?” Then I second-guessed everything, hesitated too long, and missed the move completely.

Sound familiar?

If you’ve ever felt confused or overwhelmed by trading signals, you’re not alone. But here’s the good news: once you know how to read and act on these signals—combined with solid risk management—they can become your best friend in the markets.

In this guide, I’ll break down how trading signals work, how to interpret them properly, and—most importantly—how to make decisions with confidence and discipline.

What Are Trading Signals, Really?

At their core, trading signals are indicators or triggers that suggest a good time to enter or exit a trade. They can come from:

- Technical indicators (like RSI, MACD, or moving averages)

- Price action patterns (like breakouts or candlestick formations)

- Fundamental news (such as earnings reports or economic releases)

- External services or algorithms (like a signals provider)

But here’s the secret most new traders miss:

A signal is only as good as the trader interpreting it — and the risk management behind it.

The Problem with Blindly Following Signals

A big mistake I see beginners make is chasing signals from Telegram groups, Reddit threads, or flashy YouTube channels—without understanding the why behind them.

Let me be honest with you: I did this too. I once bought into a gold trade based on a “trusted” online signal. No stop-loss, no reasoning—just hype. That trade? Down 6% in hours. My confidence took an even bigger hit.

That’s why I always say…

Don’t just follow signals. Understand them. Validate them. Manage your risk.

The Three Types of Trading Signals (And How to Use Them)

1. Technical Indicator Signals

These are based on charts and historical data. Popular examples:

- MACD Crossovers: Signal momentum shifts

- RSI (Relative Strength Index): Shows overbought/oversold conditions

- Moving Average Crossovers: Trend confirmations

✅ How to act: Always wait for confirmation. Pair signals with price action and a pre-set plan (entry, stop-loss, target).

2. Price Action Signals

This includes:

- Support and resistance breaks

- Candlestick patterns (like pin bars or engulfing candles)

- Trendlines and channels

✅ Pro tip: Combine with indicators for more reliable setups. For example, a bullish engulfing candle at a support level with RSI showing oversold = higher conviction.

3. News & Fundamental Signals

Includes:

- Central bank decisions

- Inflation data

- Company earnings (for stocks)

⚠️ These signals can move the market fast—both ways. Never trade news without a risk management plan in place.

Risk Management: The Safety Net Behind Every Signal

Here’s where things get real. You could have the strongest trading signal in the world—but without proper risk management, a single trade can wreck your account.

I’ve seen traders go 5-for-6 in accuracy but still lose money because their one losing trade was oversized or unplanned. Don’t let that be you.

The Smart Way to Combine Signals + Risk Management

Use this 5-step filter before entering any trade:

- Is the signal clear and confirmed?

- What’s your entry price?

- Where’s your stop-loss?

- What’s your target (realistically)?

- Are you risking more than 2% of your capital? (If yes—scale down!)

“Good signals don’t make money. Disciplined execution with risk control does.”

Real Talk: How I Use Signals in My Own Trading

Back when I was jumping on every alert I saw, my results were… let’s say chaotic. What changed?

I started treating every signal like a lead, not a command. Just like a detective doesn’t arrest someone based on one clue, I wouldn’t trade based on one signal. I’d gather context—trend direction, volume, volatility—and then make a measured move.

Now, I trade fewer setups—but my win rate and peace of mind are way up. That’s the power of combining signals with structure and risk management.

Actionable Tips for Reading and Using Trading Signals

Want to start using trading signals effectively right away? Here’s how:

Daily Checklist for Signal-Based Trading

- ✅ Did I verify the signal using at least two sources?

- ✅ Do I have a clear entry/exit plan?

- ✅ Have I applied proper risk management (2% rule)?

- ✅ Is this setup aligned with the overall market context?

- ✅ Am I emotionally neutral—or chasing the trade?

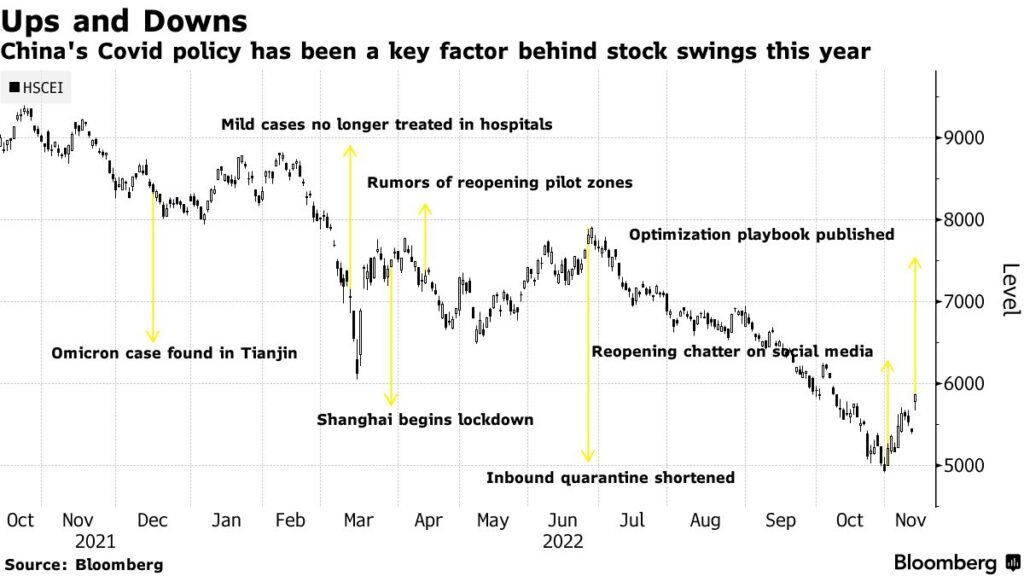

FOMO Grips China Traders in World’s Wildest Stock Market – Bloomberg

Key Takeaways

- Trading signals are tools, not guarantees.

- Always combine signals with risk management to protect your capital.

- Understand the context—don’t blindly follow alerts.

- Simpler setups with structure often outperform complicated ones.

- Confidence comes from a process, not from prediction.

Final Word from Your Friendly Trading Mentor

If you’ve made it this far, I’m proud of you. Learning how to read and use trading signals is a major step in your trading journey—but it’s just one piece of the puzzle.

Build on that knowledge with consistent routines, emotional discipline, and rock-solid risk management. That’s the real secret behind confident, consistent traders.

Because in this game, it’s not about being right every time—it’s about surviving long enough to win big over time.

Ready to take your skills further?

Don’t miss our next guide:

Trading Signals: Backtesting and Refining Your Trading Strategy. Let’s continue on the path to becoming a savvy, informed trader.

And while you’re here, check out our previous guide: Psychology of Trading: How Emotions Affect Your Success