Developing a Trading Strategy: The Smart Path from Day Trading to Swing Trading – The Novice Trader’s Playbook

Ever Feel Like You’re Just Guessing in the Markets?

When I first started trading, I was basically winging it—buying because a coin was “going up” or selling because someone on Twitter said so. Sound familiar? You’re not alone. Most new traders jump in with excitement but no real plan—and that’s where things go sideways.

In this guide, I’ll walk you through how to develop a clear, confident trading strategy—one that fits you, whether you’re drawn to the fast pace of day trading or the more measured rhythm of swing trading. Most importantly, we’ll talk about the foundation of it all: risk management.

Let’s break it down and turn that uncertainty into strategy.

What Is a Trading Strategy—And Why You Need One

A trading strategy is your personalized blueprint for entering, managing, and exiting trades. It keeps your decisions consistent, even when the market is anything but.

Without one, you’re gambling.

With one, you’re trading.

Here’s what a smart trading strategy includes:

- Entry Criteria: What needs to happen before you enter a trade? (E.g., a price pattern, news event, or indicator signal)

- Exit Rules: How do you know when it’s time to take profits—or cut losses?

- Position Sizing: How much of your account are you risking on each trade?

- Risk Management: (Yep, here it is.) How do you protect your capital long-term?

Day Trading vs. Swing Trading — Which One Fits You?

Before you build your strategy, it helps to know what kind of trader you want to be. Both styles have pros and cons, and neither is “better”—it’s about your personality, time, and goals.

Day Trading

This is for the adrenaline junkies. Day traders open and close positions within the same day—sometimes within minutes.

Pros:

- Quick feedback (and potential profits)

- No overnight risk

- More trading opportunities

Cons:

- Time-consuming

- Emotionally intense

- Higher risk without discipline

Swing Trading

Swing traders hold positions for days to weeks, aiming to catch short- to medium-term trends.

Pros:

- Less screen time

- More time to analyze and plan

- Lower stress (usually!)

Cons:

- Requires patience

- Still exposed to overnight risk

- Can miss fast moves

👉 Tip: New traders often start with swing trading because it gives you breathing room to learn and apply risk management principles without the chaos of minute-by-minute decisions.

Building Your Strategy (The Practical Way)

Here’s how to start building a strategy that actually works for you:

1. Choose Your Market & Style

Pick one: forex, crypto, commodities. Focus on just one or two assets to start. Then decide—are you day trading or swing trading?

💡 I started with BTC/USD on a 4-hour chart. It gave me enough data to analyze trends without getting overwhelmed.

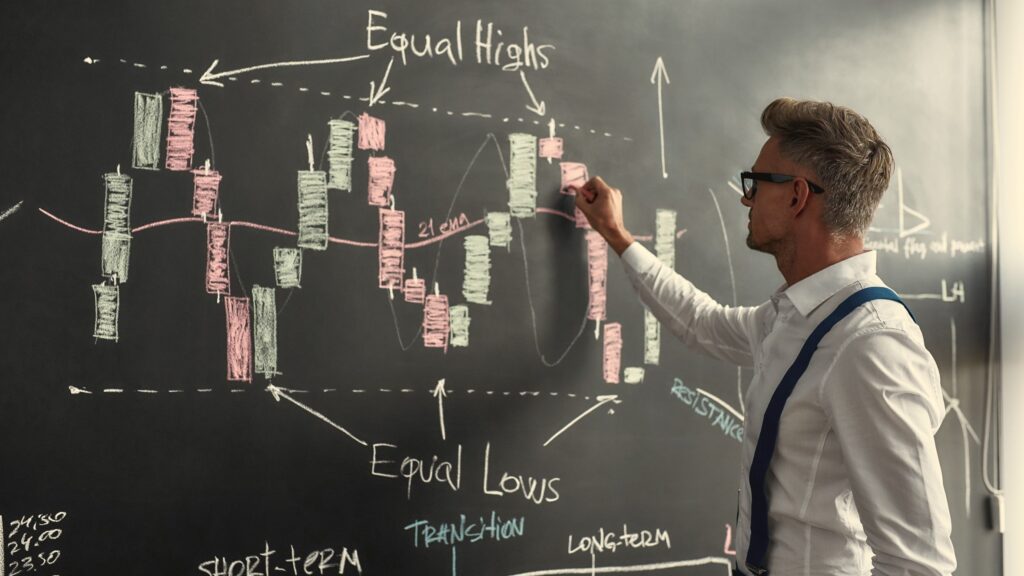

2. Set Your Entry Rules

Ask yourself: What conditions must be met before I enter a trade?

Examples:

- Moving average crossovers

- RSI below 30 (oversold) or above 70 (overbought)

- Bullish candlestick patterns at support

Always backtest your entry rules before going live.

3. Define Your Exit Strategy

Know your exits before you enter.

- Take-Profit: Where will you lock in gains?

- Stop-Loss: Where will you cut the trade if it goes wrong?

This is where risk management shines.

4. Master Position Sizing

How much should you risk per trade? A good rule of thumb: no more than 1-2% of your account on a single trade.

I once risked 10% on a “sure thing.” Spoiler alert: it wasn’t. That one trade set me back a month. Lesson learned.

5. Use a Trading Journal

Track every trade. Note what worked, what didn’t, and how you felt.

This builds discipline and reveals patterns over time—both in the market and in yourself.

Risk Management: Your Strategy’s Secret Weapon

Here’s the truth: You can survive a bad entry. But without risk management, even your best trades can blow up your account.

So what does smart risk management look like?

🔐 Key Risk Management Principles:

- Set a stop-loss on every trade. No exceptions.

- Use proper position sizing. Don’t go all-in—ever.

- Don’t chase losses. Revenge trading is real, and it’s destructive.

- Diversify smartly. Don’t put all your capital into one trade or asset.

- Stick to your plan. Emotions are the enemy of consistent returns.

Eventually, you’ll notice something powerful: it’s not just about winning trades—it’s about protecting your capital so you can stay in the game long enough to learn and grow.

Final Thoughts: Strategy + Risk Management = Confidence

Trading without a strategy is like driving blindfolded. You might not crash immediately—but it’s only a matter of time. When you take the time to build a clear plan, backed by solid risk management, you’re no longer guessing. You’re executing.

So whether you’re leaning toward the speed of day trading or the flow of swing trading, remember:

✅ Every trader starts as a beginner.

✅ Success comes from consistency, not just winning big.

✅ And risk management? That’s your foundation.

Keep learning, stay disciplined, and don’t be afraid to tweak your approach as you go. Your strategy will evolve with your experience.

Want to keep leveling up your trading mindset?

📘 Ready to take your skills further? Don’t miss our next guide: Psychology of Trading: How Emotions Affect Your Success. Let’s continue on the path to becoming a savvy, informed trader.